Check Out Top Credit Unions Cheyenne: High Quality Financial Solutions Await

Check Out Top Credit Unions Cheyenne: High Quality Financial Solutions Await

Blog Article

Unlock Exclusive Conveniences With a Federal Lending Institution

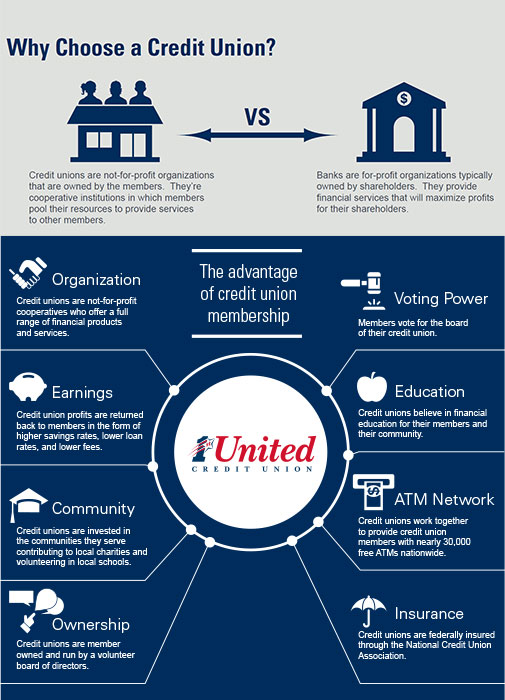

Federal Credit score Unions supply a host of exclusive benefits that can considerably affect your monetary well-being. From enhanced cost savings and checking accounts to lower interest rates on financings and customized monetary preparation solutions, the benefits are tailored to help you save cash and achieve your monetary goals extra successfully. But there's more to these benefits than just monetary advantages; they can likewise provide a complacency and neighborhood that exceeds traditional banking solutions. As we discover better, you'll find exactly how these distinct benefits can absolutely make a difference in your financial trip.

Membership Qualification Requirements

To come to be a member of a federal lending institution, people should meet details qualification criteria established by the establishment. These standards vary relying on the specific lending institution, but they often consist of aspects such as geographical area, employment in a certain industry or company, subscription in a particular company or association, or household relationships to current members. Federal lending institution are member-owned financial cooperatives, so eligibility requirements are in area to guarantee that individuals that join share a common bond or association.

Boosted Financial Savings and Examining Accounts

With enhanced savings and inspecting accounts, federal credit report unions offer members premium economic items made to optimize their money management strategies. These accounts often include greater rates of interest on savings, lower costs, and fringe benefits compared to traditional financial institutions. Participants can enjoy attributes such as competitive returns prices on interest-bearing accounts, which assist their money grow faster in time. Inspecting accounts may provide perks like no minimum equilibrium needs, free checks, and ATM cost repayments. Additionally, government cooperative credit union usually offer online and mobile banking solutions that make it practical for members to monitor their accounts, transfer funds, and pay expenses anytime, anywhere. By using these enhanced financial savings and checking accounts, participants can maximize their financial savings potential and successfully manage their day-to-day financial resources. This emphasis on providing costs financial items establishes federal cooperative credit union apart and demonstrates their commitment to helping members attain their financial goals.

Reduced Rate Of Interest on Fundings

Federal cooperative credit union give participants with the benefit of reduced rate of interest prices on finances, allowing them to obtain cash at more budget-friendly terms compared to other banks. This advantage can lead to considerable savings over the life of a funding. Reduced rate of interest indicate that borrowers pay less in rate of interest fees, minimizing the total cost of borrowing. Whether Homepage members need a financing for a car, home, or personal costs, accessing funds with a government debt union can bring about much more beneficial settlement terms.

Personalized Financial Preparation Services

Offered the concentrate on enhancing participants' monetary well-being via reduced rate of interest on lendings, government credit report unions also supply individualized financial preparation services to aid people in accomplishing their long-lasting economic goals. These personalized solutions satisfy participants' certain requirements and scenarios, offering a tailored method to economic preparation. By examining revenue, expenses, properties, and liabilities, government cooperative credit union economic planners can help members develop a detailed economic roadmap. This roadmap might consist of methods for saving, investing, retired life planning, and financial debt administration.

Moreover, the individualized financial planning solutions supplied by federal credit score unions frequently come at a lower price compared to private economic experts, making them more easily accessible to a larger series of people. Members can benefit from professional assistance and experience without incurring high fees, aligning with the cooperative credit union ideology of prioritizing members' economic wellness. In general, these services objective to encourage members to make enlightened financial decisions, build wide range, and safeguard their monetary futures.

Accessibility to Exclusive Participant Discounts

Participants of federal credit score unions appreciate unique access to a series of participant discount rates on numerous products and services. Wyoming Federal Credit Union. These price cuts are a valuable perk that can aid participants save cash on special purchases and day-to-day costs. Federal credit rating unions frequently companion with merchants, provider, and other businesses to offer price cuts solely to their participants

Members can gain from about his price cuts on a variety of items, including electronics, apparel, traveling plans, and much more. In enhancement, services such as auto services, hotel bookings, and enjoyment tickets may additionally be offered at discounted prices for debt union participants. These unique discount rates can make a considerable distinction in participants' budget plans, permitting them to enjoy financial savings on both necessary products and luxuries.

Conclusion

In conclusion, signing up with a Federal Cooperative credit union supplies many benefits, including enhanced financial savings and checking accounts, lower passion prices on financings, individualized financial preparation solutions, and accessibility to unique participant discount rates. By ending up being a member, people can profit from a variety of financial benefits and services that can assist them save money, strategy for the future, and strengthen their connections to the local area.

Report this page